Although it’s easy to forget sometimes, a share is not a lottery ticket, its part ownership of business.

– Peter Lynch

Share market

The stock market lets investors participate in the financial achievements of the companies whose shares they hold. The stock market can be split into two main sections – Primary market and Secondary market.

The Sensex is an “index” (indicator) of all the major companies of the BSE. The base value of the S&P BSE SENSEX is taken as 100 on 1 April 1979

The Nifty is an “index” (indicator) of all the major companies of the NSE, base of CNX Nifty index is November 3, 1995 and base price was 1000

Securities and Exchange Board of India (SEBI)

The regulatory body for the investment market in India. The purpose of this board is to maintain stable and efficient markets by creating and enforcing regulations in the marketplace.

Major Stock Exchange in the World

Rank 1: New York Stock Exchange – United States

Rank 2: NASDAQ – United States

Rank 3: London Stock Exchange – United Kingdom, Italy

Rank 4: Japan Exchange Group – Japan, Tokyo

Bull market

If a person is optimistic and believes that stocks will go up, he or she is called a “bullish Market” and is said to have a “bullish outlook”. (Buying opportunity)

Bear market

If a person is pessimistic, believing that stocks are going to drop, he or she is called a “bear market” and said to have a “bearish outlook”.

Stocks

When you purchase stocks, or equities, then you become a part owner of the business.

- Small-cap Stocks: Companies that have a market capitalization in the range of up to Rs. 200 crores are small cap stocks.

- Mid-cap stocks: Companies that have a market capitalization in the range of Rs. 200 crores and Rs. 1,000 crores are mid-cap stocks.

- Large-cap stocks: Companies that have a market capitalization is of Rs. 1,000 crores and more are Large-cap stocks.

- Blue chip stocks: A blue chip is a nationally recognized, well-established, and financially sound company. Blue chips generally sell high-quality, widely accepted products and services.

- Penny stocks: Penny stocks are those that trade at a very low price, have very low market capitalisation, are mostly illiquid, and are usually listed on a smaller exchange. Penny stocks in the Indian stock market can have prices below Rs 10.

Intraday Trading

A day trader often closes out all trades before the market close and does not hold any open positions overnight.

Delivery based Trading

With delivery-based trading, you can always hold a stock till it reaches the expected price.

Initial Margin

Buying stocks on margin means that you purchase the shares using money borrowed from your broker as well as your own funds. The amount of money you must put up is called the initial margin requirement.

Equity, Commodity and Currency

- Equity markets are the meeting point for buyers and sellers of stocks. The securities traded in the equity market can be either public stocks, which are those listed on the stock exchange, or privately traded stocks. (BSE/NSE).

- Commodities are natural resources like food, energy, and metals. They are traded on the commodities markets using futures contracts. The price of the commodity is subject to supply and demand. (MCX) e.g.: – Metal, Energy, Livestock and Meat.

- Currency trading is the act of buying and selling international currencies, In India Forex trading is illegal only 4 pairs available to trade USDINR, GBPINR, JPYINR, EURINR

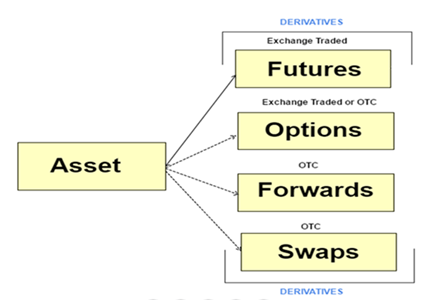

Derivative Product

- Futures contracts: A futures contract is a legal agreement, generally made on the trading floor of a futures exchange, to buy or sell a particular commodity or financial instrument at a predetermined price at a specified time in the future. Futures contracts are standardized to facilitate trading on a futures exchange.Trading is done on Lot size only.

1) Current Month, 2) Mid Month, 3) Far Month - Options: options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. The right to buy is called a call option and the right to sell is a put option.

- Forwards: It is a contractual agreement between two parties to buy/sell an underlying asset at a certain future date. It is not traded on exchange; the terms and conditions of contracts are not standardized Low liquidity, High risk.

- Swaps: Swaps are not exchange oriented and are traded over the counter, usually the dealing is oriented through banks. Currency swaps and interest rates swaps are the two most common kinds of swaps traded in the market.

There are two basic types of stock analysis:

- Fundamental analysis

Fundamental analysis is a method of evaluating a security in an attempt to measure its intrinsic value, by examining related economic, financial and other qualitative and quantitative factors. - Technical analysis

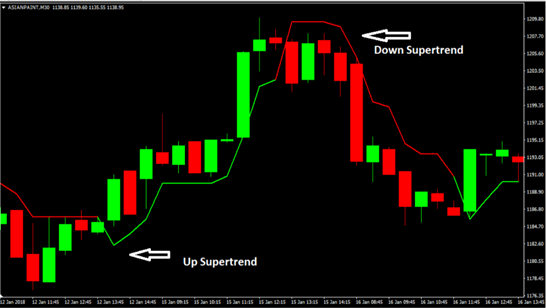

Technical analysts use trends, patterns and other indicators to assess the market’s current psychological state in order to predict whether the market is heading in an upward or downward direction.

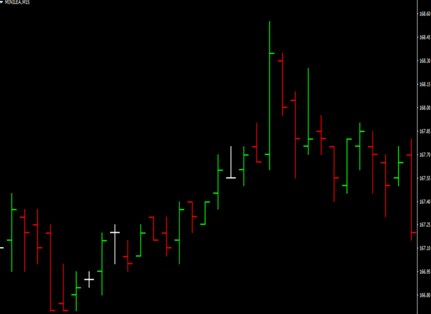

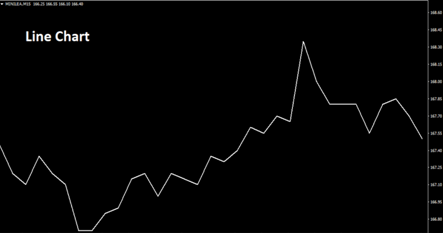

Bar Chart, Candlestick, Line Chart:

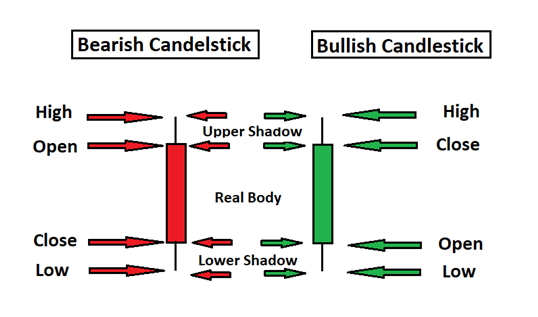

Basic Candle

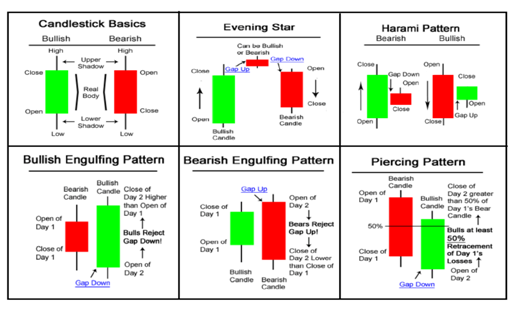

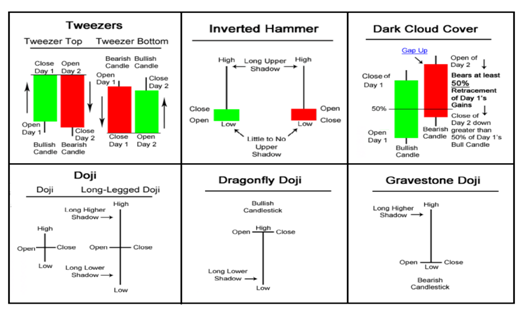

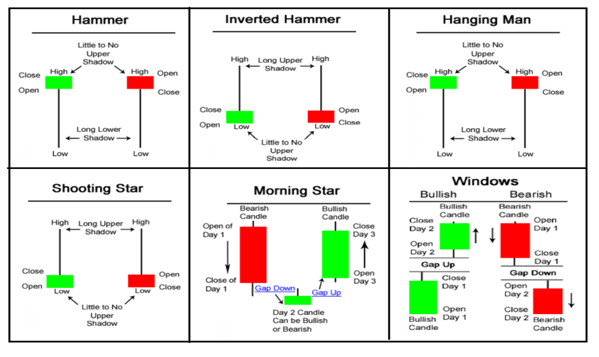

Candle Type

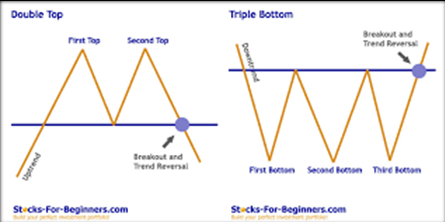

Chart Pattern

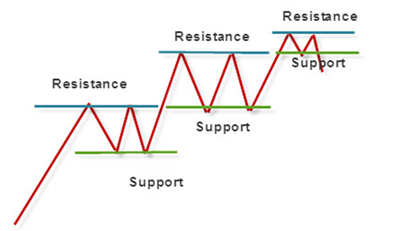

Chart patterns are used as either reversal or continuation signals. Which help us to identify up (buy) or down (sell) trend.

- Reversal Pattern

- Double Top

- Double Bottom

- Head and Shoulders Top

- Head and Shoulders Bottom

- Falling Wedge

- Rising Wedge

- Rounding Bottom

- Triple Top

- Triple Bottom

- Continuation Pattern

- Flag, Pennant

- Symmetrical Triangle

- Ascending Triangle

- Descending Triangle

- Cup with Handle

Gap up and Gap down

Technical Indicators:

- Support and Resistance

- Bollinger Band

- Super trend (Target calculation)

- MACD

- Volume

- Fibonacci Retracement

Dealer or Broker

A stockbroker is a member of a stock exchange who acts as a financial service agent to help customers buy and sell securities in financial market. He can sell securities to investors and provide insight on the market to his clients.

Trading System

A trading system is simply a group of specific rules, or parameters, that determine entry and exit points for a given equity. These points, known as signals, are often marked on a chart in real time and prompt the immediate execution of a trade.

Simple Orders

- Limit Order: A limit order is when you wish to purchase or sell a scrip at a certain price.

- Market Order: A market order is when you wish to purchase or sell a scrip at the revailing market rate

- Stop-Loss Order: An order placed to sell a scrip when itreaches a certain price is called a stop-loss order

- Stop-Loss Limit Order: As mentioned above, a stop-loss limit order will be executed at the price that you want the order to be executed at. The stop-loss is a mere trigger to validate the order

- Stop-Loss Market Order: The stop-loss market order is when once your stop-loss is triggered and the order will be placed at whatever price is prevalent in the market

Complex Orders

- Cover Order: This is a special-order type which has a market order and a stop loss market order attached to it. In this type of special order, the first leg is always a market order; once executed, the second leg (the stop loss market order) is placed. The stop loss order cannot be cancelled.

1st Leg Explanation

- Limit order: A limit order is when you wish to purchase or sell a scrip at a certain price. When you place a limit order it will be executed only when the scrip reaches that price. IF you have selected a Limit Price at Buy CO entry then you have to give below the market price. And if you have selected a Limit price at Sell CO entry then you have to give above the market price.

- Market Order: A market order is when you wish to purchase or sell a scrip at the prevailing market rate. A market order will be executed at whatever market rate is prevalent at the time the order is placed.

2nd Leg Explanation

- Stop-Loss Market Order

The stop-loss market order is when once your stop-loss is triggered the order will be placed at whatever price is prevalent in the market. In this kind of Stop loss order, only the trigger price is to be mentioned. Once the trigger price is hit, the order becomes a market order and is sent to the exchange.OCO – One Cancels Other (Bracket Orders) A bracket order can be used to limit your loss and lock in a profit by “bracketing” an order with two opposite-side orders. - Trailing Stop Loss ticks:

Trailing stop loss is to trail your stop loss for which you will face less loss for your trade. A trailing stop order sets the stop price at a fixed amount below the market price with an attached “trailing” amount. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss price doesn’t change, and a market order is submitted when the stop price is hit. - Upper circuit and Lower circuit

Upper limit (circuit) is the maximum price at which a particular share can quote for buying / selling. Lower limit (circuit) is the minimum price at which a particular share can quote for buying / selling.

I know from experience that nobody can give me a tip that will make more money for me than my own judgement.

– Jesse Livermore